Earn Higher Returns on Your Capital.

We are actively seeking to structure new ground leases and acquire existing ones, and we are able to deliver on all property types. We can provide a highly competitive portion of your capital stack.

We are actively seeking to structure new ground leases and acquire existing ones, and we are able to deliver on all property types. We can provide a highly competitive portion of your capital stack.

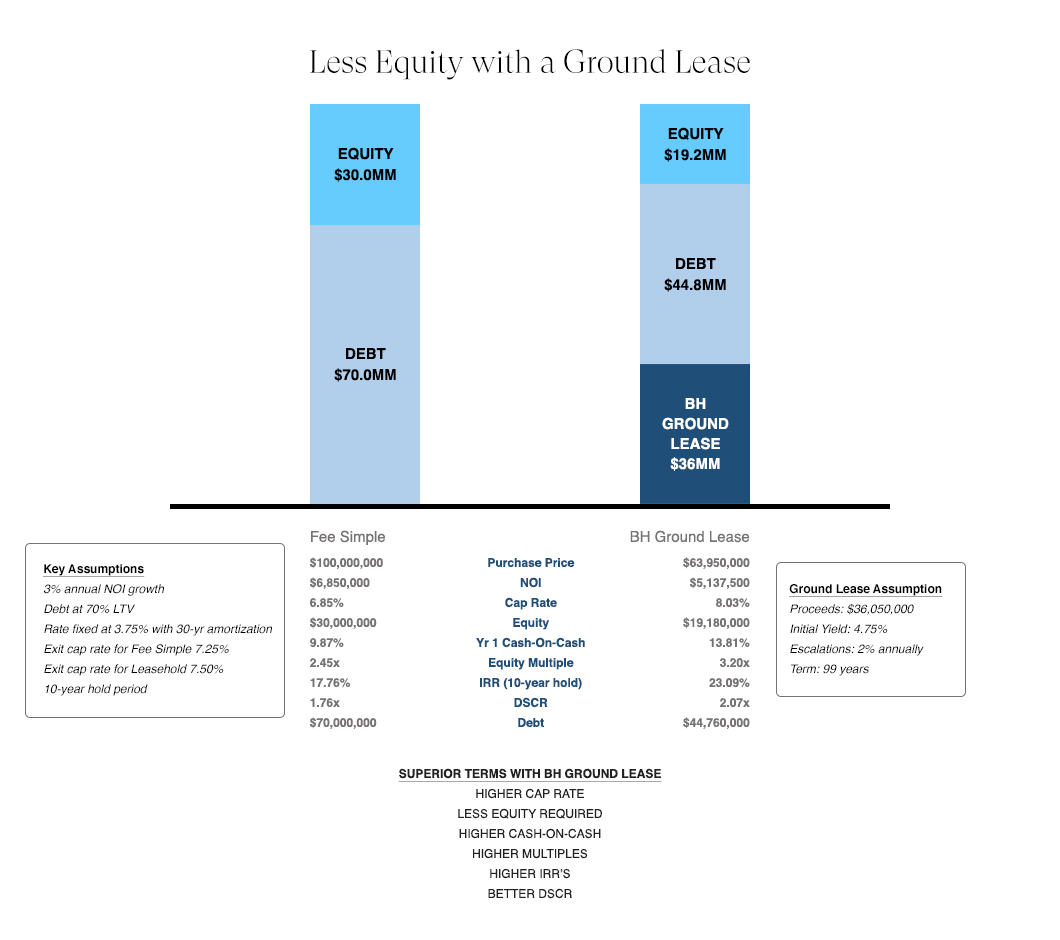

A ground lease can help fund a significant portion of a sponsor’s acquisition or recapitalization, and provides low-cost permanent capital with no immediate balloon risk. We can structure it based on your needs.

BH bought the leased fee and simultaneously created a 99-year ground lease for the acquisition of a new 298-unit luxury apartment. The leasehold buyer brought in BH to provide just over 40% of the purchase price along with a leasehold lender providing another 75% of the remaining purchase price, allowing for much less equity than traditional financing to close. BH’s ground lease was approved by Fannie Mae as part of the leasehold 10-year fixed rate loan.

This 298-unit apartment in Fort Myers Florida is a retreat where tenants can flourish and enjoy life.

BH acquired the leased fee interest in three parcels in Manhattan secured by ground leases with 96 years remaining and improved with 3 select service hotels. The seller was a publicly traded REIT and the transaction also required BH to assume several hundred million in existing financing.

A 43-story DoubleTree Hotel located in the Financial District offering magnificent views of Manhattan, Brooklyn, and Ellis Island.

A 40-story Element Times Square Hotel (“Element”) opened in 2010 and is conveniently located in New York City’s leading submarket, Times Square.

The modern 21-story Sheraton TriBeCa Hotel and is conveniently located at the intersection of SoHo and TriBeCa.

BHProperties.Com meets the standards of ADA compliance for accessible design. Great care has been taken to ensure that this site is accessible to all. The following features have been identified and ensured to be accessible: slideshow, form, map, accordion, card, modal, infinite scroll and file downloads. This site was in compliance in accordance with the Web Content Accessibility Guidelines (WCAG) Version 2.1 as of March 17, 2021. View detailed audit results.